The expression “elections have consequences” will certainly be put to the test in 2019. The dust is still settling on the recent mid-term elections with some races remaining to be decided. However, we do know that 2019 will bring us a divided US Congress with (as of 11/14/2018) Republican control of the Senate having 51 seats compared to 47 Democratic seats (includes two Independents) and two races undecided. In the House of Representatives the Democrats will gain control of the House with 226 seats compared to 200 Republican seats and nine races still undecided.

How will this divided Congress function? Will there be bipartisan cooperation? Will the two parties become more entrenched? These are the questions, and ultimately their answers, we need to be ready for in 2019. There will be some big ticket items on the agenda for 2019, but before I get too far ahead, one issue remaining for this Congress to watch – the December 7th government funding deadline. 2019 will quickly follow with the new Congress taking on such issues as the debt ceiling, infrastructure and a host of other topics including US trade policy.

US trade policy has clearly been and continues to be a very hot topic of debate and conversation in the United States and is also being carefully watched in many parts of the world. There is no question that traditional trade policies of the US are being reviewed and that discussions are ongoing with many trading partners around the world. Some examples of trade policies under consideration include:

- Unites States Mexico Canada Agreement (USMCA) formerly known as the North American Free Trade Agreement (NAFTA)

- Section 232 – Steel & Aluminum Tariffs

- Section 232 – Automotive & Automotive Parts Tariffs

- Section 301 – Tariffs on Chinese Products

- Trans Pacific Partnership (TPP)

- Transatlantic Trade & Investment Partnership (TTIP)

- Japanese Free Trade Agreement

- Korean Free Trade Agreement

- Others

ITA has a long tradition of supporting free and fair trade and all of our comments on trade policies have been very consistent over the years – we believe in the elimination of tariffs and trade barriers – and that position remains unchanged today.

The Economy

According to the International Monetary Fund’s latest World Economic Outlook report, “the global economy is projected to grow 3.9 percent in 2018 and 2019. However, risks to growth are mounting as the rate of expansion appears to have peaked in some major economies and growth has become less synchronized. In addition, tariff increases and retaliatory measures by trading partners have increased the likelihood of escalating and sustained trade actions which could hinder growth prospects.” The US economy remains strong despite these risks.

One driver of stability in the U.S. economy has been the reported stronger real GDP growth. Real gross domestic product was reported at an annual rate of 3.5 percent in the third quarter which follows the reported 4.2 percent in the second quarter of 2018.

In July, the unemployment rate edged down by 0.1 percentage point to 3.9 percent from the previous month. Year-over-year, the unemployment rate is down 0.4 percentage points. The US Labor Department states that “total nonfarm payroll employment rose by 157,000 in July showing increases in professional and business services, in manufacturing, and in health care and social assistance. Manufacturing added 37,000 jobs in July, with most of the gain in the durable goods component. Over the past 12 months, the U.S. manufacturing sector has added 327,000 jobs. Total non-farm payroll employment showed an average monthly gain of 203,000 over the prior 12 months.”

New orders for manufactured durable goods in June increased $2.5 billion or 1.0 percent to $251.9 billion according to the U.S. Census Bureau. The June increase, up following two consecutive monthly decreases, followed a 0.3 percent May decrease. New orders for transportation equipment are also up following two consecutive monthly decreases, increased 2.2% or $1.9 billion, during June reaching $87.7 billion.

The United States’ international trade deficit in goods and services increased to $46.3 billion in June from $43.2 billion in May, as exports decreased and imports increased. June exports of $213.8 billion were offset by imports of $260.2 billion. This is a very popular talking point of the current US Administration and often pointed to when discussing trade policy, as mentioned at the beginning of the article.

U.S. light-vehicle sales slowed in July. July’s seasonally adjusted annual rate of 16.7 million units was even with the year-over-year comparison, but a sharp decline from June’s 17.2 million and lowest since last August. The automotive sector is paying close attention to the Administration’s review of section 232 and potential tariffs on the automotive sector. The Tax Foundation (an independent tax policy non-profit) released a new analysis in November estimating that blanket 25 percent tariffs on all imports could cause a $53.1 billion economic hit and lead to the loss of more than 164,000 jobs.

US Forklift Industry

The strong economic conditions in the US continue to have a positive impact on forklift truck sales as the North American market continues its unprecedented increase. 2017 marked the third consecutive year of growth, with over a quarter million units sold in 2017, representing a 9.5% increase from 2016 and a 12.2% increase over 2015.

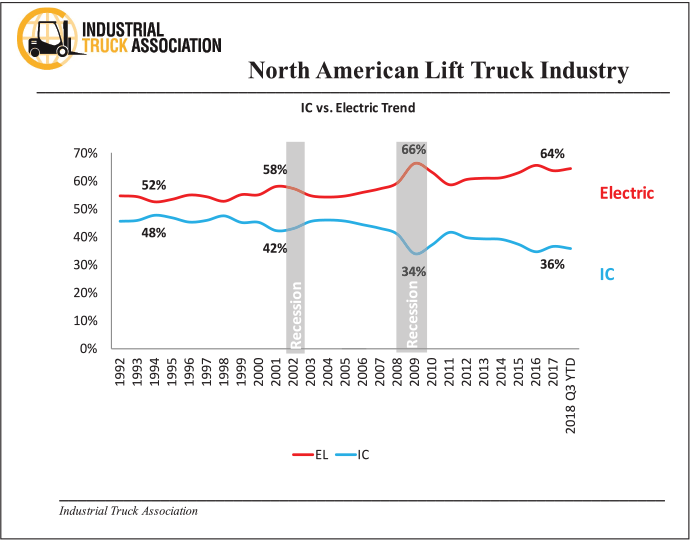

Reaching the quarter-million unit mark in sales was a major milestone for the industry. All truck classes demonstrated an increase from 2016, including a 19% growth in the internal combustion class 5 trucks. Overall, electric products account for approximately 64% of the market in 2017. Strong market conditions continue for the industry in 2018 with a total (all classes 1-5 combined) increasing by an annualized 1.4% through September 2018 versus CY 2017. Manufacturers are optimistic for 2019.

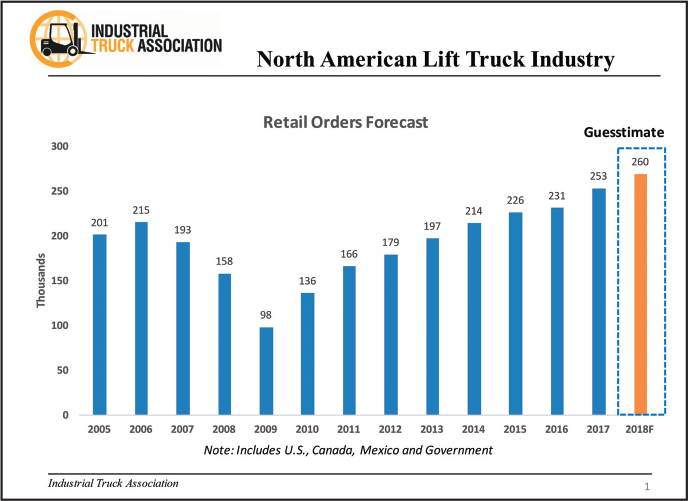

Retail orders for all five truck classes in 2017 were approximately 253,000 orders, which exceeded our pre-recession level of 215,000 units. When considering where we were in 2009 with only 98,000 units, our industry in North America has rebounded quite well and can be characterized as mature and healthy. Industry “guestimates” for 2018 remain positive with approximately 260,000 units.

This growth speaks well of the current business environment our industry is enjoying and also reminds us of how prevalent our products are in all facets of our economy.

This past June we celebrated our 5th annual National Forklift Safety Day in Washington, DC. This day provides an opportunity for the industry to raise awareness and educate customers, policymakers and US government officials on forklift operating safety practices. Experience has (and will continue) to allow us to refine our message and grow participation in the event.

Speakers at the NFSD 2018 event in Washington, DC included:

- Mr. Scott Johnson, ITA Chairman of the Board and Vice President of Sales and Marketing, CLARK Material Handling

- Ms. Loren Sweatt, Deputy Assistant Secretary, Occupational Safety and Health Administration

- Mr. Tommy Nguyen, Staff Director for Senator Johnny Isakson (R-GA) on the Senate Health, Education, Labor and Pensions (HELP) Committee’s Subcommittee on Employment and Workplace Safety

- Ms. Jane Terry, Senior Director, Government Affairs, National Safety Council

- Mr. Jim Mozer, ITA National Forklift Safety Day Chairman and Senior Vice President, Crown Equipment Corporation

- Dr. Wes Scott, President, CEO, Global EHSS Leadership Solutions, appointed by the Secretary of Labor to serve on the NACOSH Committee with his term ending in 2018.

We are looking forward to and encourage all industry professionals to join us for our 6th annual National Forklift Safety Day next year – which will be held on June 11, 2019.

There are certain to be challenges and opportunities in 2019. The uncertainty surrounding the political climate, government budgets/debt, domestic & foreign policy decisions and their impact on the economy are all factors that can influence markets. So we focus on certainty – economic data, industry market data and existing policies and procedures that will help dictate future directions. It’s easy to get caught up in the hype of the 24 hour news cycle but business and industry decisions based on hard data minimize the risk of uncertainty. Thank you.